Profiting from cryptocurrency trading requires a systematic approach, and trading strategies provide the necessary framework for organising techniques. You can consistently monitor and optimise your cryptocurrency trading endeavours by establishing a coherent strategy.

When building your trading strategy, it’s essential to understand the two main schools of thought: Technical Analysis (TA) and Fundamental Analysis (FA). These concepts differentiate the approaches for various strategies, and it’s crucial to grasp their distinctions before delving further.

While numerous trading strategies exist, this article focuses primarily on cryptocurrency trading strategies. However, many of these strategies apply to other financial assets such as forex, stocks, options, or precious metals like gold.

If you aspire to create your own trading strategy, this article provides the fundamentals for approaching speculative trading in the crypto markets. A robust trading strategy increases the likelihood of achieving your trading and investment objectives.

What Is A Trading Strategy?

A trading strategy is a well-defined and systematic plan that outlines a trader’s approach to buying, selling, and managing positions in financial markets, including cryptocurrencies. Traders follow a set of rules and guidelines to make informed decisions based on market analysis, risk tolerance, and investment objectives.

A trading strategy typically includes key elements such as asset type, entry and exit signals, position sizing, risk management techniques, and criteria for selecting trading opportunities. It helps traders navigate the complexities of the market by providing a structured framework for decision-making and reducing emotional biases.

A trading strategy can be based on various factors, including technical analysis, fundamental analysis, or a combination of both. It aims to capitalise on market trends, price patterns, market indicators, and other relevant factors to identify potential trading opportunities with favourable risk-reward ratios.

A trading plan can also help mitigate financial risk, as it eliminates a lot of unnecessary decisions. While having a trading strategy is not mandatory for trading, it can sometimes be life-saving. If something unexpected happens in the market (and it will), your trading plan should define how you react – not your emotions.

4 Essential Cryptocurrency Trading Strategies for Every Trader

Successful cryptocurrency trading requires a solid understanding of various volatile market strategies. Here are four essential trading strategies that every trader should know:

Active Trading Strategies:

Active strategies demand increased time and focus, earning their name due to the continuous monitoring and regular portfolio management they entail.

Trend Trading:

This strategy involves identifying and following the prevailing market trends. Traders analyse price charts and indicators to determine the market’s direction and make trades accordingly. They aim to buy during an uptrend (when prices are rising) and sell during a downtrend (when prices are falling).

Trend traders aim to identify and follow these trends by analysing price charts, technical indicators, and other relevant market data. They seek to enter trades in the direction of the trend, looking to buy during uptrends (when prices are rising) and sell during downtrends (when prices are falling).

Once a trend is identified, trend traders typically enter positions and hold them until there are signs of a trend reversal or weakening. They aim to capture most of the trend’s movement, maximising potential profits. Stop-loss orders are commonly used to manage risk and protect against significant losses if the trend reverses unexpectedly.

Scalping:

Scalping is one of the fastest trading strategies available, focusing on capitalising on frequent small price movements rather than significant trends. Scalpers aim to exploit opportunities such as bid-ask spreads, liquidity gaps, or market inefficiencies to generate profits.

Unlike traders who hold positions for extended periods, scalpers swiftly enter and exit trades, often within seconds. This close association with High-Frequency Trading (HFT) is common in scalping strategies.

Scalping can be highly profitable when traders identify recurring market inefficiencies they can exploit consistently. With each occurrence, they accumulate small profits that accumulate over time. This strategy thrives in markets with high liquidity, where entering and exiting positions are smoother and more predictable.

Scalping is not recommended for beginners due to its complexity. It demands a profound understanding of market mechanics and dynamics. Additionally, scalping is generally more suitable for large traders, commonly known as “whales,” as the percentage profit targets are smaller.

It’s important to note that successful scalping requires careful risk management, swift decision-making, and access to real-time market data. Traders must be proficient in executing trades efficiently and keen to identify fleeting opportunities.

Also Read: 6 Important Cryptocurrencies Other Than Bitcoin

Passive Trading Strategies

Passive trading strategies offer a more hands-off approach, requiring less time and attention for portfolio management.

Buy And Hold:

The “buy and hold” strategy is a passive investment approach where traders purchase an asset with the intention of holding it for an extended period, irrespective of market fluctuations.

This strategy is commonly employed in long-term investment portfolios, emphasising participation in the market rather than timing entry points. The underlying principle is that the timing or entry price becomes less significant over a sufficiently long time horizon.

Fundamental analysis forms the basis of the buy-and-hold strategy, typically disregarding technical indicators. Traders employing this approach do not frequently monitor portfolio performance, instead reviewing it sporadically.

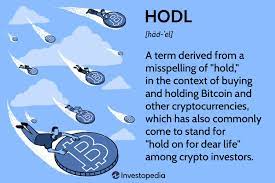

While Bitcoin and cryptocurrencies have emerged in the past decade, the “HODL” phenomenon can be likened to the buy-and-hold strategy. However, it’s important to note that cryptocurrencies represent a volatile and risky asset class. While buying and holding Bitcoin has become a well-known strategy within cryptocurrency, the buy-and-hold approach may not be suitable for other cryptocurrencies.

Index investing

Index investing typically involves purchasing ETFs and indices in traditional markets. However, this investment approach is also available in the cryptocurrency markets through centralised cryptocurrency exchanges and within the realm of Decentralized Finance (DeFi).

The concept behind a crypto index is to create a token that mirrors the collective performance of a basket of crypto assets. This basket may consist of coins from a particular sector, such as privacy coins or utility tokens, or it could encompass a diverse range of assets as long as reliable price data is available. Usually, these tokens heavily rely on blockchain oracles for accurate pricing information.

Investors can utilise crypto indexes by investing in a specific index rather than selecting individual coins. For instance, they can invest in a privacy coin index, allowing them to gain exposure to the privacy coin sector while mitigating the risk of investing in a single coin.

Tokenised index investing is expected to gain popularity in the coming years as it provides a more hands-off approach to investing in the blockchain industry and cryptocurrency markets. It enables investors to participate in the market’s overall performance without the need for active management of individual assets.