In recent years, Africa has witnessed a significant shift in its approach to cryptocurrency, transitioning from outright bans to a more regulated and favourable environment for digital assets.

According to Chainalysis, Africa is witnessing rapid growth in its crypto market, although it still holds the position of being the smallest among global markets. In mid-2021, monthly crypto transactions in Africa reached a peak of $20 billion. Kenya, Nigeria, and South Africa emerge as the countries with the highest user base in the region. While many individuals utilise crypto assets for commercial payments, their inherent volatility renders them less suitable as a reliable store of value.

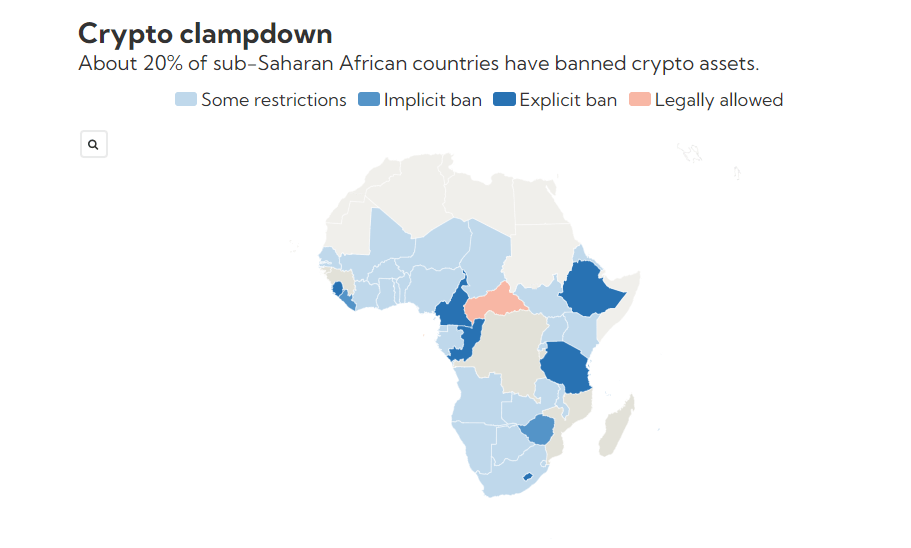

Policymakers are expressing concerns regarding the potential misuse of cryptocurrencies for illicit fund transfers out of the region and as a means to bypass local regulations to prevent capital outflows. Additionally, the widespread adoption of crypto can potentially undermine the efficacy of monetary policy, thereby posing risks to financial and macroeconomic stability.

Why Does Cryptocurrency Keep Growing In Africa Despite The Challenges?

The economic instability in Africa has sparked a growing interest in cryptocurrency as a means to safeguard earnings and facilitate cross-border transactions.

One of the primary reasons Africans are turning to cryptocurrency is its protection against the volatility and inflation rates of traditional currencies. Unlike fiat currencies tied to a single country’s economy, cryptocurrencies like Bitcoin are not subject to the same inflationary pressures. This enables individuals in African countries to preserve the value of their earnings and shield themselves from the adverse effects of a failing economy.

Cryptocurrencies offer a high level of security through cryptographic protocols. Blockchain technology stores transaction records transparently and tamper-proof, preventing fraud and ensuring the integrity of transactions. This added layer of security gives Africans peace of mind when conducting online transactions with virtual currencies, protecting them from potential cyber threats and fraudulent activities.

Cryptocurrencies like Bitcoin provide a convenient solution for cross-border transactions in Africa. Traditional payment methods, like Paypal, have faced restrictions and bans due to fraudulent activities. In contrast, cryptocurrency transactions are facilitated by blockchain technology, which operates on a decentralised system. This decentralised nature ensures that transactions cannot be easily banned by any single country, allowing Africans to conduct cross-border payments more efficiently.

Crypto Regulation As A Solution

Various African countries have moved to legislation from ban on their cryptocurrency stand. A notable development to mention is Morocco’s transition from a total ban on digital currencies to initiating a legislative framework. While it’s challenging to ascertain the situation in every country, several nations with existing bans are actively working towards implementing legislation related to digital currencies or exploring the concept of a Central Bank Digital Currency (Nigeria is a popular example). The World Economic Forum is developing a central bank digital currency policy toolkit. This toolkit aims to provide guidance to central banks on creating digital currencies that align with their monetary policies. By following these guidelines, Kenya can potentially establish its official digital currency while maintaining the integrity of its monetary policy and ensuring financial stability. Moreover, a central bank’s digital currency needs to coexist harmoniously with traditional forms of currency, such as notes and coins, supplementing their existing role.

Although the current statistics heavily favour bans, significant progress is being made in the field. Regardless of their government’s involvement, Africans are inclined to adopt digital currencies. Given sufficient time, the tide often shifts in favour of the people’s will, indicating that the right steps are being taken at the grassroots level.

Undeniably, digital currencies/assets and blockchain technology will revolutionise the payments landscape in Africa and change the financial market. Early adopters will have an advantage!

Also read: Dart Africa: The Safest And Most Reliable Platform To Sell Your Bitcoin