Dollar-cost averaging is one of the ways to maintain a good investment portfolio. DCA is a tool used by stock brokers before the mainstream adaptation of cryptocurrency. It has proved to help mitigate the risk of volatility stocks in the market.

What Is Dollar Cost Averaging (DCA)?

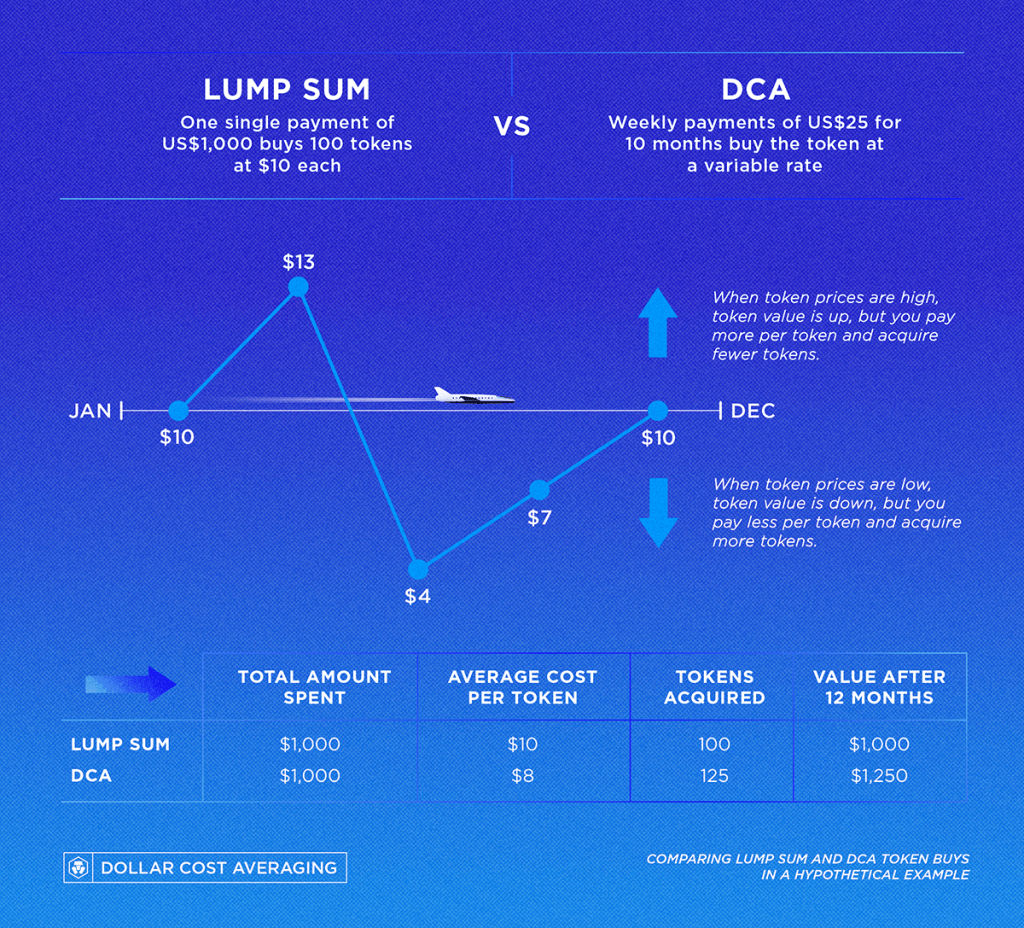

Dollar-cost averaging (DCA) is based on the concept of systematically investing a predetermined amount of capital at regular intervals (such as weekly, biweekly, or monthly) into a selected asset (for example, investing $200 in Bitcoin every month for a year instead of $2,400 at once). The objective is to mitigate the effects of price volatility by averaging out the purchase cost over time. Rather than making a single large investment, individuals allocate their funds into smaller portions spread evenly over consistent intervals. This approach helps smooth out market fluctuations’ impact on the overall buying price.

Why not buy at once when the market price is the lowest? Because it’s challenging to know when the price will be at its lowest.

This approach is commonly referred to as “timing the market,” and statistical evidence indicates that even seasoned financial professionals encounter challenges in accurately predicting market movements. If individuals whose expertise revolves around comprehending and forecasting market behavior face difficulties timing it well, the likelihood of everyday cryptocurrency users achieving favorable outcomes is even lower.

What are the benefits of DCA?

DCA offers a practical approach to cryptocurrency ownership, eliminating the challenges of market timing and the risk of investing all funds at a market peak. By consistently investing reasonable amounts, regardless of asset prices, DCA allows for cost averaging over time and minimizes the impact of sudden price drops on individual purchases.

Additionally, DCA investors can continue scheduled buying if prices decline, potentially benefiting from future price recoveries and earning returns.

When is DCA more effective than lump-sum investing?

An investor can enter a market safely with the aid of DCA, begin to profit from long-term price growth and balance off the danger of short-term price declines. And in the circumstances like the ones listed below, it might provide more predictable profits compared to making a significant investment all at once:

Uncertain market conditions: DCA is beneficial in unpredictable or volatile market conditions. Instead of investing a large sum at once, DCA allows you to spread out your investments over time, reducing the risk of making a significant investment right before a market downturn.

Emotional decision-making: DCA helps mitigate the impact of emotional decision-making. By investing regularly and consistently, regardless of short-term market fluctuations, DCA encourages a disciplined approach and reduces the temptation to make impulsive investment decisions based on market highs or lows.

Psychological comfort: DCA can offer peace of mind to investors who prefer a more gradual entry into the market. It allows individuals to ease into investing and adjust to the market’s ups and downs without feeling overwhelmed by a large lump-sum investment.

Large cash reserves: DCA can be a prudent strategy if you have a large sum of cash you’d like to invest but are uncertain about the ideal entry point. By gradually investing the cash over time, you reduce the risk of investing it all at a suboptimal time.

Disadvantages Of Dollar Cost Averaging

Dollar-cost averaging (DCA) can lead to increased trading costs due to fees charged by trading platforms for each transaction; however, it is primarily designed as a long-term strategy. Over the course of two, five, or ten years and beyond, these fees should become relatively small compared to the potential gains you can achieve.

One potential drawback is the possibility of purchasing assets at a high point in their price trajectory, followed by a subsequent downward correction. However, a dollar-cost averaging (DCA) strategy typically involves purchasing assets consistently over time, regardless of whether they are stable, depreciating, or appreciating. This approach reduces risk and generally performs well when considering a long-term investment horizon.

In Summary:

Dollar-cost averaging is a strategy aimed at managing investment risk by diversifying investments over time. It involves regularly investing fixed amounts, regardless of market conditions, with the goal of reducing the impact of short-term price fluctuations on your portfolio. While it may limit potential gains, it is a prudent option for investors looking to safeguard against significant losses resulting from market volatility.

You can also practice a Hybrid form of Dollar cost averaging by setting aside some portion of your capital, say 25%, to buy cryptocurrencies when the price experience a substantial price reduction. Another way to practice Hybrid DCA is by limiting buying crypto in the bubble territory. Historically, once Bitcoin has gone above 3 to 5x its previous all-time high, this has tended to indicate that BTC is in bubble territory.

How to Sell Bitcoin

You can sell Bitcoin (BTC) and other cryptocurrencies in Dart Africa, for the highest exchange rate and as swiftly as possible. Simply create an account on the platform and start enjoying the best exchange service in Africa.

Also read : How To Sell Bitcoin In Nigeria 2023