Bitcoin showcased a robust performance throughout 2021, achieving a peak price of $67,617.02 on November 9, 2021 – the highest ever recorded. Yet, it experienced a decline below $50,000 in December, followed by further weakening in 2022. By July 2023, its value persists at approximately $30,000.

Despite the considerable price fluctuations in the cryptocurrency market, which present notable risks, numerous retail investors continue to be enticed by its allure. The emergence of NFTs and the metaverse has added an extra layer of dynamism to the cryptocurrency landscape. A platter of investors aspires to capitalise on the potential for substantial gains by venturing into cryptocurrencies like Bitcoin, Ethereum, Litecoin, Solana, Dogecoin, Cardano and so on.

Within this article, we will explore the processes and where to acquire Bitcoin in Hong Kong, along with an overview of the prevailing cryptocurrency landscape within the country.

Where To Buy Bitcoin In Hong Kong

Over the past few years, numerous online platforms have significantly streamlined the various ways to buy Bitcoin and secure it.

There are two categories of platforms to buy Bitcoin in Hong Kong, you can buy with Spot Trading or Over-The-Counter Trading on an Online Crypto Exchange.

Buying Through Spot Trading

Buying cryptocurrencies is most straightforward through spot trading on platforms like Binance, Kucoin, Kikitrade, Huobi, Bitget, Tidebit, and ByBit. These platforms, known as “exchanges,” “Crypto exchange shops,” or “trading platforms,” offer user-friendly interfaces. You can pay with your Mastercard, Visa cards, and bank transfers for your crypto purchase on these platforms, though specifics can differ by platform.

Opting for credit or debit cards for Bitcoin purchases presents advantages in terms of convenience, speed, and security. Nevertheless, the transaction fee might be higher relative to traditional transactions, and most credit cards don’t provide cash-back incentives for cryptocurrency acquisitions.

Buying cryptocurrencies like Bitcoin through spot trading involves purchasing cryptocurrencies for immediate delivery at their current market price. This means you are acquiring the actual cryptocurrencies and owning them directly.

Spot trading allows you to hold the cryptocurrencies in your wallet, providing more control and potential for long-term ownership.

How To Buy Bitcoin Through Spot Trading

Follow the steps below to buy cryptocurrency on an exchange platform through spot trading, note, requirements may differ a little bit based on platforms but these steps cover most platforms;

Proceed with the following steps to buy cryptocurrency via spot trading on an exchange platform. Keep in mind that there might be slight variations in requirements across platforms, but these steps generally encompass the process:

- Sign Up and Complete KYC: Create an account on any of the cryptocurrency exchange platforms mentioned. Provide necessary information and complete the KYC (Know Your Customer) process as required.

- Deposit Funds: Deposit your preferred fiat currency (in this case, USD or Hong Kong Dollar) into your exchange account using available payment methods, which may include bank transfers, credit/debit cards, or other payment options.

- Navigate to Spot Trading: Once your account is funded, navigate to the spot trading section of the platform. This is where you can buy and sell various cryptocurrencies at their current market prices.

- Select Cryptocurrency Pair: Choose the cryptocurrency pair you want to trade. For example, if you want to buy Bitcoin with USD, select BTC/USD, if it is Ethereum with HK$, select ETH/HK$.

- Place Order: There are two types of orders: market and limit. A market order is executed instantly at the current market price, while a limit order allows you to specify the price at which you want to buy. Enter the amount of cryptocurrency you wish to purchase and confirm the order.

- Review and Confirm: Double-check your order details and review the transaction summary. Confirm the purchase to execute the trade.

- Cryptocurrency Allocation: Once your order is executed, the purchased cryptocurrency will be credited to your exchange account’s wallet.

- Secure Your Assets: To enhance security, consider transferring the purchased cryptocurrency to a private wallet that you control. This is especially important for long-term storage.

How To Buy Bitcoin Through OTC (Over The Counter) Trading

Over-the-Counter (OTC) trading through online crypto exchanges refers to a method of trading cryptocurrencies that occurs directly between two parties, facilitated by an exchange platform. OTC trading allows buyers and sellers to execute trades without the need for order books. Instead, they interact directly with each other or through a dedicated OTC desk provided by the exchange.

The procedure parallels that of an online marketplace:

- Sellers post their available cryptocurrencies for sale on the platform.

- Buyers initiate contact with sellers via the platform to acquire the desired cryptocurrencies.

- Both parties reach a consensus on the trade volume, settlement currency, and transfer mechanism.

- Before the buyer’s payment, the platform secures the seller’s cryptocurrencies on the exchange.

- Once the buyer finalises the payment, the seller verifies the trade with the platform and proceeds to transfer the cryptocurrencies to the buyer’s account.

Numerous cryptocurrency exchanges offer users access to OTC trading solutions, often referred to as “off-exchange trading,” “C2C,” or “peer-to-peer” trading. Binance, a widely recognized platform, is among the notable providers of this particular trading method.

Here are some advantages of using OTC trading solution:

- OTC trading can offer enhanced privacy and security for both buyers and sellers.

- OTC trading helps prevent significant price fluctuations in the open market.

- Trades typically involve larger volumes of cryptocurrencies than what is commonly seen on the regular exchange.

- Trading also incurs lower transaction costs than buying Bitcoins with a credit card.

All you need to do is access the OTC segment within your chosen exchange platform. For instance, on Binance, you can head to the P2P section. From there, you can review the array of sellers and select the one that aligns with your preferences. Proceed to make the payment to the seller’s account, and you’ll promptly receive your desired cryptocurrency.

Is Bitcoin Legal In Hong Kong?

The Hong Kong government does not consider Bitcoin as a legal tender, but it is also not prohibited. It is treated as a virtual commodity.

🌎 Explore the global status of Bitcoin and cryptocurrency legality.

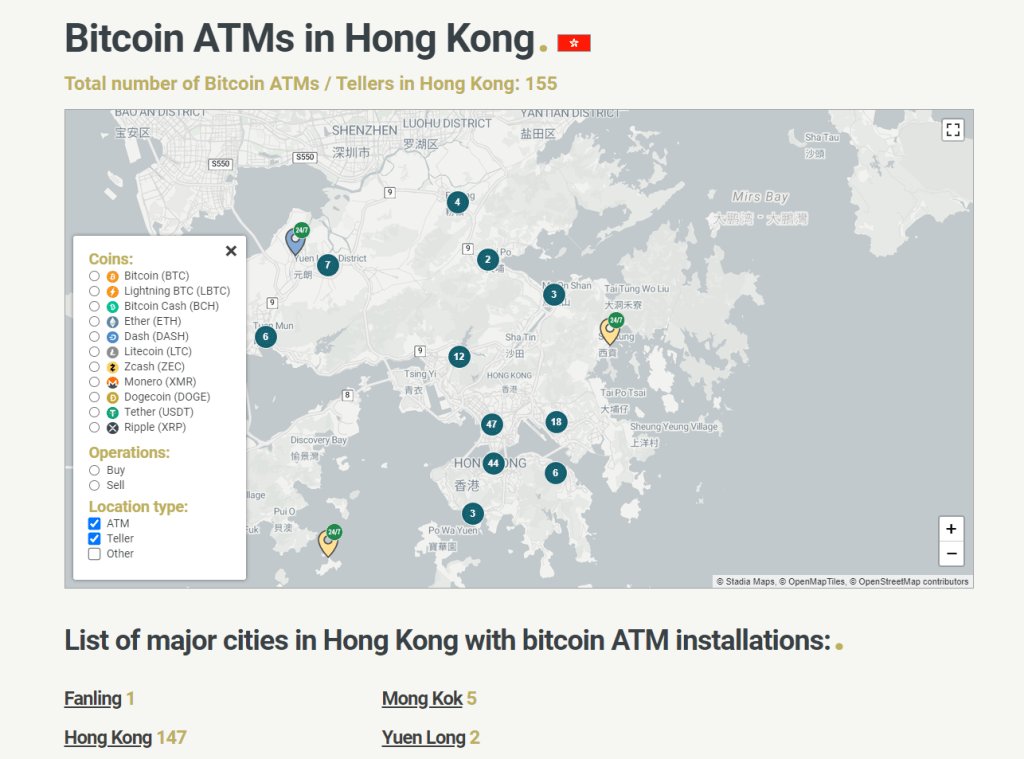

Bitcoin ATMs In Hong Kong

A Bitcoin ATM differs from traditional bank ATMs, as it is designed for self-service transactions involving popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Buying Bitcoins via a Bitcoin ATM is a quick and straightforward process. Typically, users need to create an account, deposit funds, and scan a QR code from the cryptocurrency wallet to complete the transaction within minutes. In Hong Kong, companies like HK Bitcoin ATM and CoinUnited.io provide Bitcoin ATMs and similar services can be found in other regions. However, it’s important to note that transaction fees are generally higher, and there might be a price variation.

Currently, there are a total of 147 Bitcoin ATMs conveniently located in various cities across Hongkong, providing users with a straightforward way to participate in cryptocurrency transactions.

Follow this link to check for Bitcoin ATMs around your vicinity.

Cryptocurrency Storage Methods: Cold Wallet vs Hot Wallet

When it comes to securely storing your cryptocurrencies, there are two primary methods: cold wallets and hot wallets. Each approach has its own advantages and drawbacks, catering to different needs and levels of security for cryptocurrency holders.

Cold Wallets

A cold wallet, also known as cold storage, refers to a cryptocurrency wallet that is kept completely offline. This isolation from the internet makes it highly resistant to hacking and online threats. There are two main types of cold wallets:

1. Hardware Wallets: These are physical devices designed to securely store your private keys offline. They come in the form of USB-like devices and are considered one of the most secure options. Hardware wallets are immune to online attacks as they never expose your private keys to the internet. They are ideal for long-term storage of large amounts of cryptocurrencies. An Example is the Trezor wallet.

2. Paper Wallets: A paper wallet is a physical document that contains your cryptocurrency’s private and public keys. It is usually generated offline and can be printed or written down. While paper wallets provide a high level of security, they are also vulnerable to physical damage or loss, such as fire or theft.

Advantages of Cold Wallets

- High security: Cold wallets are immune to online hacking and malware attacks.

- Offline storage: They provide a safe way to store cryptocurrencies for the long term.

- Protection from exchange hacks: Your funds are not exposed to the security vulnerabilities of cryptocurrency exchanges.

Drawbacks of Cold Wallets

- Less convenient for frequent transactions: Cold wallets are not as easily accessible for making regular transactions due to their offline nature.

Hot Wallets:

A hot wallet, on the other hand, is connected to the internet and is used for day-to-day transactions. There are different types of hot wallets:

1. Online Wallets: These wallets are provided by online cryptocurrency exchanges. While convenient for trading and transactions, they are more vulnerable to hacking compared to other hot wallet options.

2. Mobile Wallets: Mobile wallets are smartphone apps that allow you to store, send, and receive cryptocurrencies. They strike a balance between security and convenience, as they are accessible on the go.

Advantages of Hot Wallets:

- Convenient for daily use: Hot wallets are suitable for making quick transactions and managing smaller amounts of cryptocurrencies.

- Accessibility: You can access your funds from any device with an internet connection.

Drawbacks of Hot Wallets:

- Increased security risks: Hot wallets are more vulnerable to hacking, phishing attacks, and malware.

- Exchange dependency: If you store your cryptocurrencies on an exchange’s hot wallet, you are relying on the exchange’s security measures.

Also Read: How Buy Cryptocurrency In UAE

Sell Bitcoin On Dart Africa

At Dart Africa, we provide a hassle-free way to convert cryptocurrency to fiat and withdraw to your local bank instantly. Our user-friendly platform is tailored for Ghana and Nigeria, allowing seamless trading of popular cryptocurrencies like BTC and ETH. We’re expanding our offerings to suit various preferences. A key benefit is fee-free transactions, setting us apart from other platforms and banks.

Our platform is designed with user-friendliness in mind, ensuring simple navigation and secure transactions. To get started with DartAfrica simply create an account with your credentials and follow the prompts.