If you’re just starting out in the world of cryptocurrency, there’s a whole lot to learn! It’s an exciting space where people can make money, but it’s important to remember that it’s not without its risks.

In the crypto market, some folks find success and make profits, while others unfortunately end up losing money. It’s a rollercoaster ride with ups and downs. So, as a newcomer, take the time to educate yourself. Understand the basics, explore different coins, and learn about the factors that can influence their value. Don’t rush into anything.

A trading strategy refers to a plan that crypto traders use to make informed decisions and execute trades in the market. It’s like having a game plan before stepping onto the field. A trading strategy takes into account various factors such as market trends, price patterns, technical indicators, and risk management. It helps traders identify entry and exit points for buying or selling cryptocurrencies.

Here are some of the common trading strategies for beginners:

Trend Following

Trend following is a popular trading strategy in cryptocurrency that involves analyzing and capitalizing on market trends. The idea behind trend following is to ride the momentum of an established trend, whether it’s upward or downward. Traders using this strategy pay close attention to price movements to determine the direction of the trend.

Once a trend is identified, they aim to enter a trade in the same direction as the trend, hoping to profit from the continuation of that trend. The strategy relies on the belief that trends tend to persist for a certain period before reversing. Risk management is important in trend following, as traders set stop-loss orders to limit losses if the trend reverses unexpectedly.

Breakout Trading

Breakout trading is a trading strategy commonly used in cryptocurrency markets, aiming to capture significant price movements when a cryptocurrency breaks through a defined support or resistance level. Traders employing this strategy closely monitor price charts and identify key levels where the cryptocurrency’s price has historically struggled to break or sustain.

When the price finally breaks through one of these levels with substantial momentum, traders enter positions in the direction of the breakout, anticipating further price movement. The strategy assumes that a breakout often indicates the start of a new trend or an acceleration of the existing one.

Swing Trading

Swing trading is a strategy widely used in the cryptocurrency market that aims to capture shorter-term price fluctuations within an established trend. Traders employing this strategy look for price swings or oscillations between support and resistance levels. Rather than focusing on long-term trends, swing traders aim to capitalize on the ups and downs of the market, seeking to enter trades at points where they anticipate a potential reversal or continuation of a short-term price movement.

They set specific entry and exit points based on technical indicators, chart patterns, and market analysis. Swing trading involves holding positions for a few days to several weeks, allowing traders to take advantage of price movements within that timeframe.

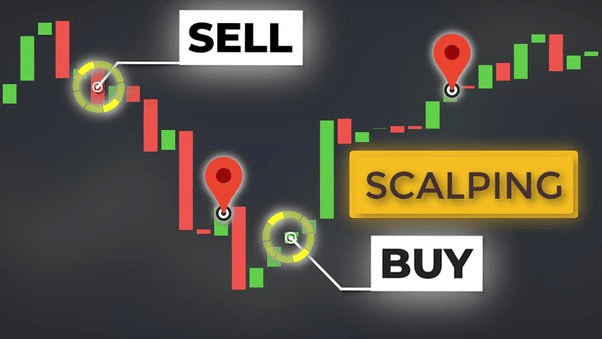

Scalping

Scalping is a strategy widely employed in the cryptocurrency market, focusing on making quick profits from small price movements. Scalpers aim to capitalize on short-term market fluctuations, executing numerous trades within a brief timeframe. They take advantage of small price differentials by buying at the bid price and selling at the ask price, aiming to profit from the spread.

Scalpers rely on technical analysis and utilizing indicators to identify entry and exit points. The duration of each trade is typically short-lived, ranging from seconds to minutes. Risk management is very important in scalping, as traders set tight stop-loss orders to limit losses if the market moves against their position.

Crypto Trading Tips for Beginners

If you’re new to crypto trading, here are some helpful tips to get you started on the right foot.

- Do your research: Before diving into crypto trading, take the time to research and understand the basics. Learn about different cryptocurrencies, their technology, and the factors that can influence their value. Stay updated with news and market trends to make trading decisions.

- Start with a plan: Create a trading plan that outlines your goals, risk tolerance, and strategies. Stick to your plan and avoid making impulsive decisions based on emotions. Set limits on the amount you’re willing to invest and the losses you can afford, ensuring you don’t put all your eggs in one basket.

- Use reputable exchanges: Choose well-established cryptocurrency exchange to ensure the security of your funds. Research user reviews, security features, and transaction fees before selecting an exchange. If you’re a crypto trader looking to exchange your digital assets into cash, Dart Africa is the perfect solution for you. Whether you’re in Nigeria or Ghana, we cater specifically to traders in these regions, making sure they have a smooth experience.

- Practice risk management: Understand that cryptocurrency markets can be highly volatile. Never invest more than you can afford to lose. Diversify your portfolio by investing in multiple cryptocurrencies, reducing the risk of significant losses if one underperforms.

- Continuously learn: The crypto market is constantly evolving, so stay curious and keep learning. Follow expert traders, join communities, and utilize educational resources to expand your knowledge. Adapt your strategies as you gain experience and learn from your successes and mistakes.

It is important to remember that a trading strategy is not a guarantee of profits, but rather a tool to help traders navigate the volatile crypto market effectively. By using a well-defined trading strategy, traders aim to minimize risks and maximize potential gains based on their analysis.